Adding an annuity to your IRA can provide you with retirement income that you can’t outlive.

Consider adding an annuity to your IRA if you want:

- Income that lasts your lifetime

A one-life annuity provides income payments to you for as long as you live.

- Income that lasts your lifetime – and someone else’s

A two-life annuity provides lifetime income to you and, upon your death, to your chosen annuity partner (for example, your spouse) for the rest of his or her life.

-

An income floor with annuity income

Create a retirement income “floor” that will enable you to cover necessary expenses like food, shelter, utilities, clothing and healthcare every month.

- Competitive costs

Expenses on our annuities are generally less than half the mutual fund industry average, so more money stays in your account.1

- A guaranteed account2

A fixed account such as TIAA Traditional provides guaranteed growth every day and a guarantee against loss while you’re accumulating assets; plus, the option to receive income guaranteed to last the rest of your life. that you cannot outlive in retirement.

- Help figuring it all out

TIAA can provide advice or guidance at no additional cost to help you figure it all out — which investments are right for you, how much to put in each, and how to receive income in retirement.

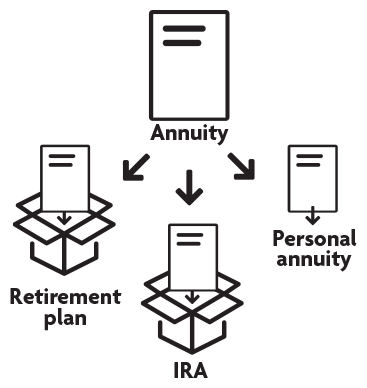

How to add an annuity to your IRA

1. Open an IRA with TIAA3

2. Invest or transfer other retirement accounts into your new IRA

3. Choose from the available fixed and variable annuities

4. Keep putting money in your IRA until you retire

5. Select your income option at retirement

1. Open an IRA with TIAA3

2. Invest or transfer other retirement accounts into your new IRA

3. Choose from the available fixed and variable annuities

4. Keep putting money in your IRA until you retire

5. Select your income option at retirement